What is Margin Trading & How it Supercharges Your Trades

Understanding Margin Trading

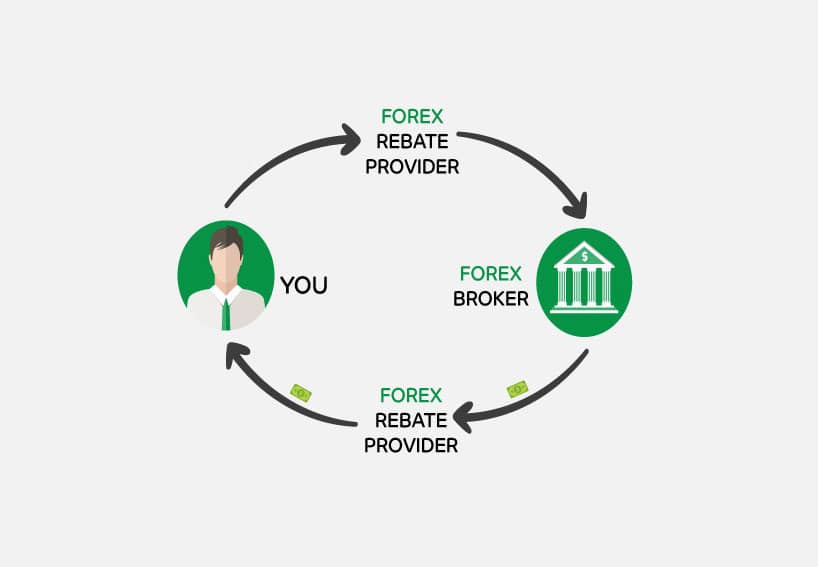

Margin trading, also known as leverage trading, is a technique that enables traders to control larger positions than the amount of capital they have in their trading accounts. It essentially allows you to borrow funds to increase your trading position. While margin trading can supercharge your trades, it’s essential to grasp the mechanics before diving in.

How Margin Trading Works

The basic premise of margin trading is relatively straightforward. Instead of trading with just your own capital, you borrow funds from your broker to increase your trading position. Here’s a step-by-step breakdown of how it works:

1. Capital and Margin Account:

To start margin trading, you need a margin account with a broker. In this account, you deposit a certain amount of capital, known as the initial margin.

2. Leverage Ratio:

Your broker offers you a leverage ratio, typically expressed as a fraction or a percentage (e.g., 50:1 or 2% margin). This ratio determines how much capital you can control for every dollar in your account.

3. Borrowed Funds:

When you place a trade, the broker lends you the additional funds required to open the position. These borrowed funds are used to supplement your trading capital.

4. Increased Position Size:

With the borrowed funds, your trading position is now larger than your initial capital alone would have allowed. This amplifies the potential profit (or loss) from the trade.

Benefits of Margin Trading

Margin trading offers several advantages for traders:

1. Amplified Profits:

By controlling larger positions, you can potentially earn more substantial profits if your trade goes in the desired direction.

2. Diversification:

Margin trading allows you to diversify your portfolio and take advantage of various trading opportunities, even with limited capital.

3. Cost-Efficiency:

It can be cost-effective since you don’t need to invest the full position size upfront. You only pay the interest on the borrowed funds.

4. Shorting Opportunities:

Margin trading also enables you to profit from falling markets by short-selling assets you don’t own.

5. Hedging:

Traders can use margin to hedge their positions, protecting against potential losses in other investments.

6. Liquidity:

Margin trading can provide access to larger and more liquid markets, allowing traders to participate in assets that might be out of reach with their own capital.

Risks of Margin Trading

While the benefits of margin trading are enticing, it’s equally important to understand the associated risks:

1. Magnified Losses:

Just as profits can be amplified, losses can be magnified. If a trade moves against you, you could face substantial losses, and you might even owe more money than your initial capital.

2. Margin Calls:

To mitigate the risk of losing more than your initial capital, brokers issue margin calls if your losses approach a certain threshold. You must either deposit more funds or close losing positions to meet the call.

3. Interest Costs:

Borrowed funds come with interest costs. While they are typically lower than what you can earn from a successful trade, they add an ongoing expense to your trading.

4. Emotional Pressure:

Margin trading can be emotionally challenging. The prospect of large losses can lead to impulsive and irrational decisions.

5. Limited Recovery Time:

If a trade goes against you, you have limited time to recover before your losses become severe, especially when margin calls are issued.

Using Margin Trading Effectively

Now that you understand what margin trading is, and the potential benefits and risks it carries, here are some tips for using it effectively:

1. Risk Management:

Always have a risk management plan in place. Set stop-loss orders to limit potential losses, and only risk a small percentage of your capital on any single trade.

2. Start Small:

If you’re new to margin trading, start with a small amount of leverage. As you gain experience and confidence, you can gradually increase your leverage.

3. Education:

Educate yourself thoroughly on the assets you’re trading, the markets, and the specific trading strategies you plan to employ. Knowledge is your best defense against the risks of margin trading.

4. Discipline:

Stay disciplined and stick to your trading plan. Avoid making impulsive decisions based on emotion.

5. Regular Monitoring:

Keep a close eye on your positions. Check your margin levels and monitor your trades regularly to avoid margin calls.

6. Understand the Costs:

Be aware of the interest costs associated with borrowing funds for margin trading. Factor these costs into your overall trading strategy.

7. Consider Diversification:

Diversify your trading portfolio to spread risk. Don’t concentrate your margin trading on a single asset or market.

8. Prepare for Margin Calls:

Have a plan in place for handling margin calls. Know in advance how you will respond to protect your capital.

Wrapping Up

Margin trading is a potent tool that can supercharge your trades, allowing you to control more significant positions and potentially earn substantial profits. However, it comes with a commensurate level of risk, including the potential for magnified losses, margin calls, and interest costs.

To use margin trading effectively, it’s essential to approach it with a solid understanding of the markets, a well-thought-out risk management plan, and a disciplined approach.

By doing so, you can harness the power of leverage while minimizing the associated risks, making margin trading a valuable addition to your trading strategy. Remember that prudent and informed decisions are your best allies in the world of margin trading.